I warned that New Zealand would be used as a tax haven on October 26th, 2011, if the National government was reelected.

Never did I expect we would be proven right in such a spectacular fashion as via the Panama Papers leak.

A leak that has shone light on an agenda to use New Zealand as a port of safe harbour for vast swathes of foreign cash. An agenda that does not stem solely from the ruling Party. It comes from on high.

From the description of the above video, posted in April 2014:

“Last month, the kiwi government tabled a bill that would remove the current 28% tax rate on income incurred by non-residents investing in funds held in New Zealand.

The move by the government is the latest to entice investors to domicile assets on its shores. A year ago, prime minister John Key, a former Merrill Lynch banker, created a focus group to examine how the nation could become more welcoming to foreign assets and enlisted consultant Oliver Wyman to examine the country’s options.

The consultancy’s recommendation was to market New Zealand as a funds domicile in the Asia-Pacific region.”

The Puppet-Masters

As depicted in ‘House of Cards‘, even at Presidential level, the real government is who the leaders of countries talk to when they get home at night.

And who they are talking to is people with great wealth, who know damn well what a foreign trust is, and how to utilise tax havens to their benefit.

Tax havens like New Zealand, run for the last eight years by arguably the most pro-Wall Street, pro-America Prime Minister in generations: ex-Member of the Federal Reserve Bank of New York, John Key.

New Zealand and the Panama Papers

New Zealand is once again in an uproar and debate is evolving at a swift pace. It has just discovered that it is a laundering haven for drug money and other illicit international funds, and that the personal lawyer of the leader of the country was involved in lobbying to ensure that the legislative status quo with regards to offshore trusts remained intact.

Our already-scandal-plagued Prime Minister is doing his best to cling to power, attempting to sidestep these latest revelations as deftly as he has countless prior instances of mass public indignation – rare moments in which the mostly-cowed and constantly-culled national press corp begin to do their job.

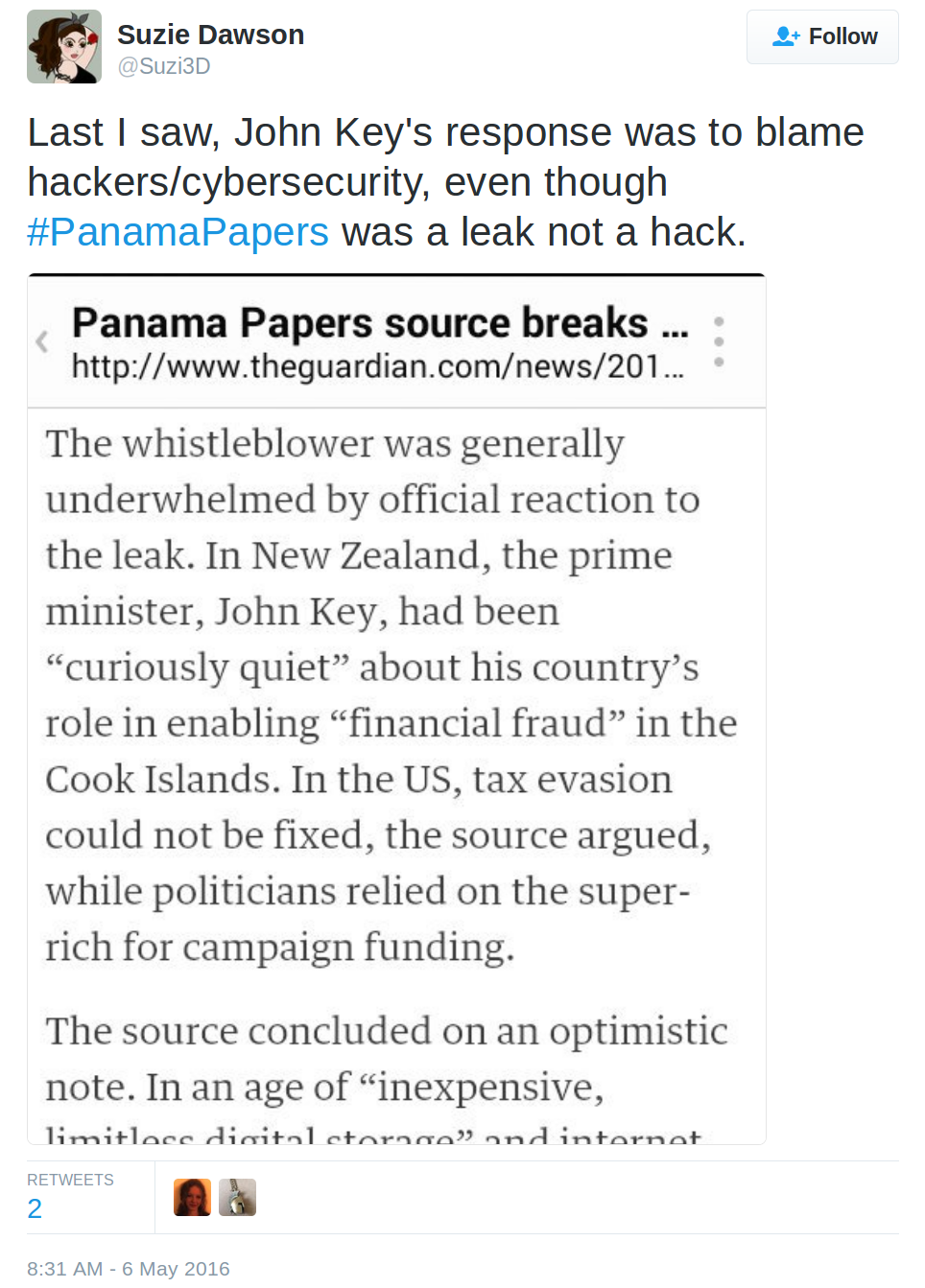

After all, the Panama Papers’ whistle-blower’s recent statement singled out John Key and New Zealand.

The Standard wants to know, why?

Because we are a country run by a man who has helped unleash this same agenda upon other countries before, with disastrous effect.

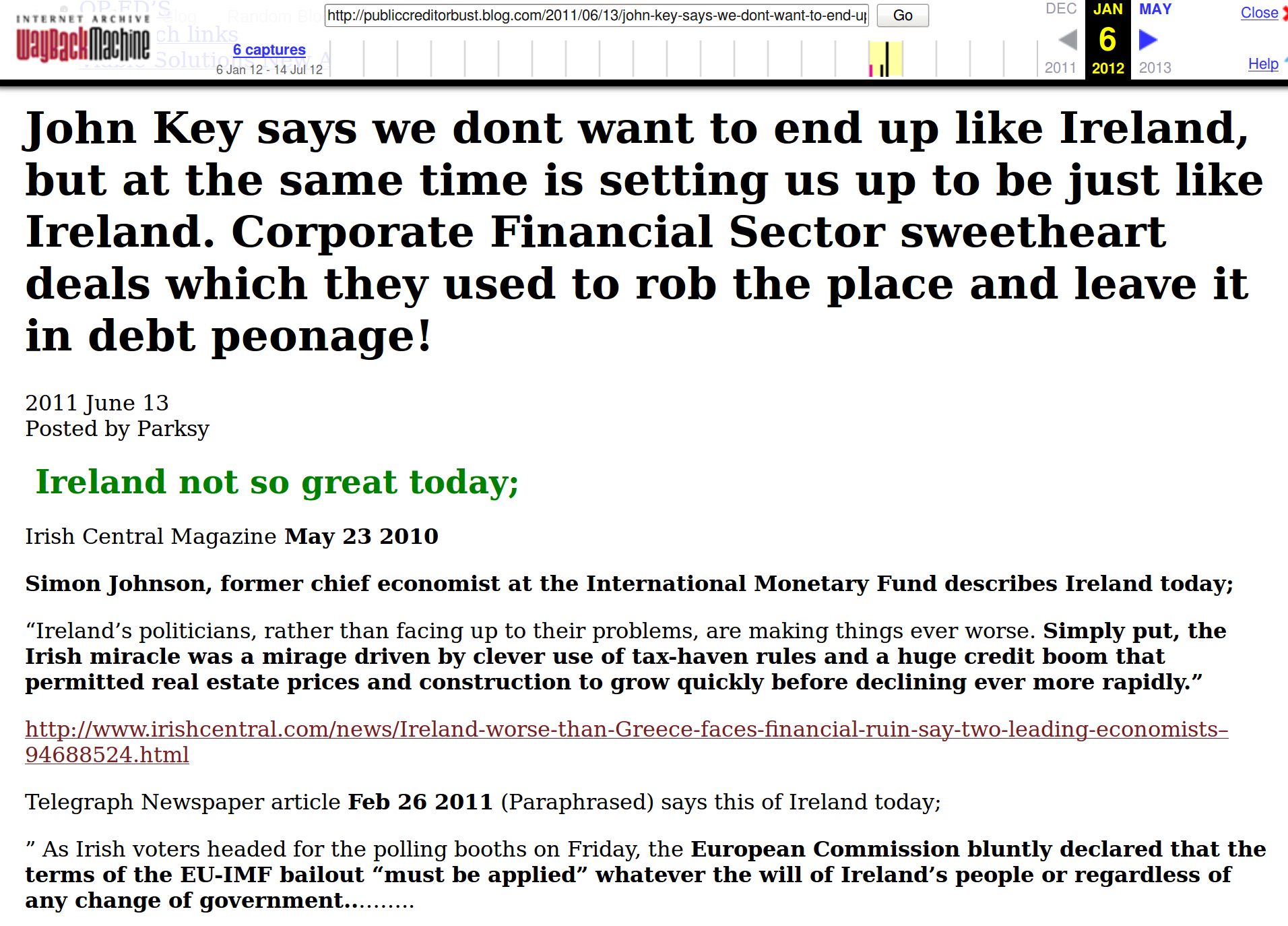

Back in 2011, Ireland was Greece. Being strong-armed by the IMF, bound to Greek-style austerity measures to stave off impending bankruptcy.

Bankruptcy that loomed because of “a mirage driven by clever use of tax-haven rules and a huge credit boom that permitted real estate prices and construction to grow quickly before declining ever more rapidly.”

Guess who was making full use of Ireland to reduce the tax liability of offshore funds on behalf of his wealthy clientele?

John Key.

How do we know this?

Because he said so.

New Zealand Prime Minister Telling Porkies

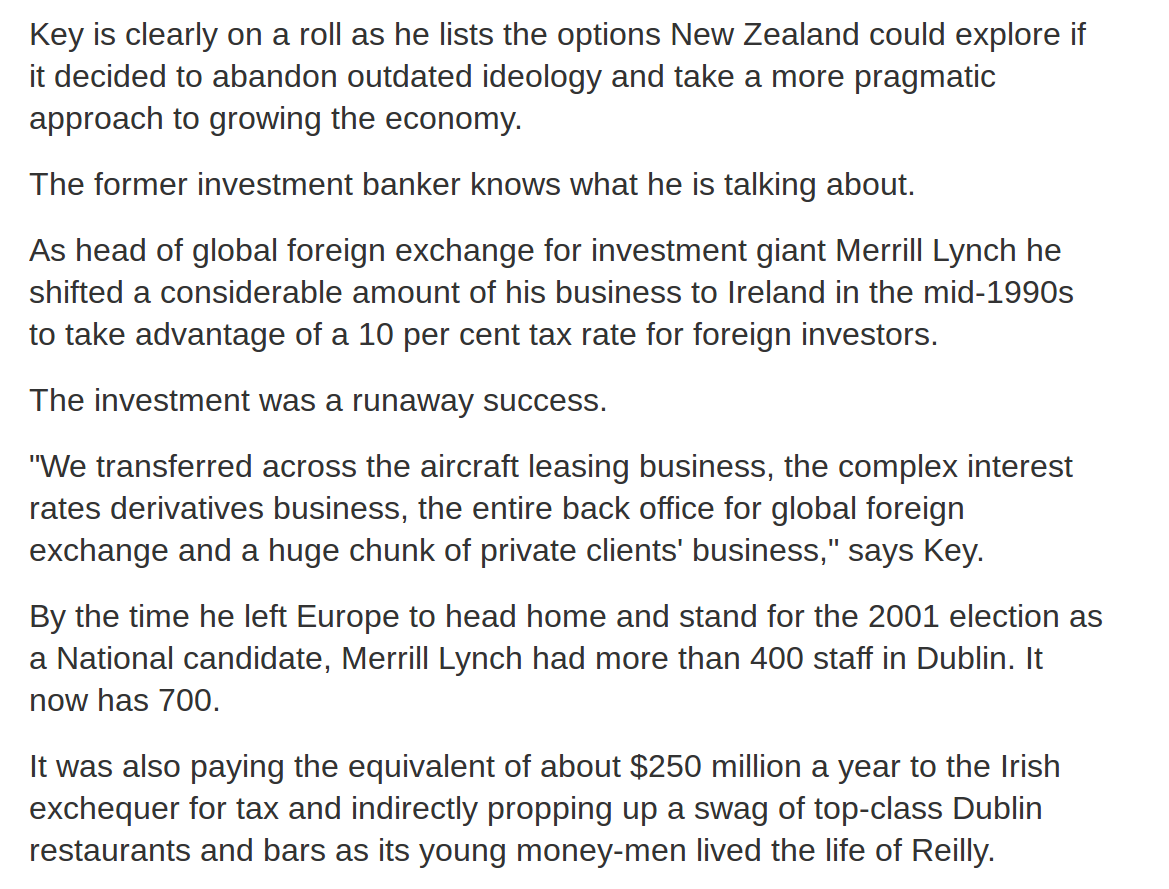

In an enthusiastic 2005 interview with Fran O’Sullivan of the NZ Herald, then future Prime Minister of New Zealand John Key bragged about how his moving businesses and funds offshore to Ireland had saved his Merrill Lynch clientele megabucks.

From the July 19, 2005 article:

Key words… ‘Head of global foreign exchange’; Ireland; “..huge chunk of private clients’ business”.

Fran O’Sullivan writes of Key, “But as a former money-man, he is also interested in how Jersey built its economy on the back of offshore trusts.”

However, this doesn’t seem to faze the NZ Herald, which on April 6th, 2016, effectively whitewashed the O’Sullivan article.

While the above ‘offshore trusts’ quote is addressed in a forgiving tone (bizarrely, by being reiterated), there is no mention whatsoever of the “huge chunk of private clients’ business” that Key moved to Ireland for tax purposes as Head of global foreign exchange for Merrill Lynch.

Yet by contrast, in this video of his May 9th press conference, Key has the following exchange:

Reporter: “The Papers show that a lot of the overseas people are using it for business interests, not connected to inheritance or things that you’ve talked about in terms of opposition parties in countries that are unstable and that sort of thing. What reason would someone, in Mexico for example, using a business deal, have to set up a trust in New Zealand?”

John Key: “So the first thing you appreciate is that I haven’t seen the papers. So it’s very difficult to comment when I can’t see the individual cases. Nor am I a tax expert so I can’t comment on individual cases. But, for example, apparently there was one case that I just heard someone talking about where the person was Mexican, and had set up a Trust because they were uncertain about Mexican inheritance law, tax law, and that’s legitimate.

In short: He doesn’t know what’s in the Papers, even though he was Minister in charge of the New Zealand equivalent of the CIA. He “isn’t a tax expert” and says he can’t comment on individual cases… but then does.

The exchange continues:

Reporter: “There are plenty of examples that just refer to straight business deals. So why would someone with no connection to New Zealand be setting up Trusts here?”

John Key: “I can’t answer why that is. Well, New Zealand is a jurisdiction which is a good jurisdiction to do that and for all the reasons that we know. That we do have exchange of information, that we do have transparency, that we do meet the highest possible codes, so there’s all sorts of reasons that people might, but you have to go and ask those who establish those why they do that, I’m just not an expert in that area.”

So John Key, who moved an “aircraft leasing business, the complex interest rates derivatives business, the entire back office for global foreign exchange and a huge chunk of private clients’ business” to Ireland on behalf of one of the biggest investment banking firms in the world, in order “to take advantage of a 10 per cent tax rate for foreign investors” – an “investment” described as a “runaway success” – is “not a tax expert”.

He claims that the reason all these overseas businesses are setting up accounts in New Zealand is purely because of good compliance and transparency.

Over 10,000 in total – flocking to New Zealand because they want increased compliance and visibility?

In the infamous words of Dr. Jane Kelsey – “I think I just saw a flock of flying pigs go by!”

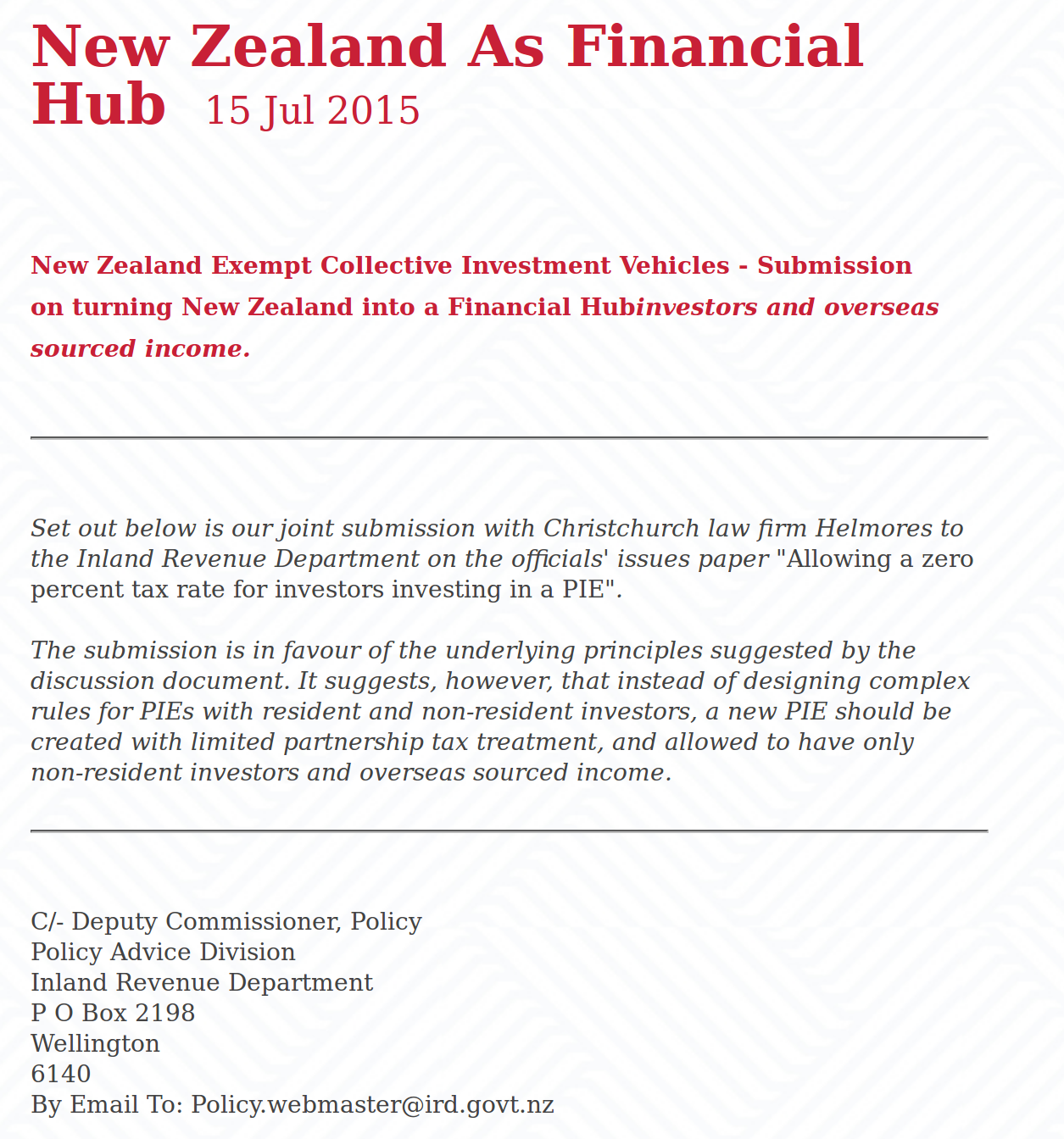

Some professional tax and trust lawyers have been so good as to publish a copy of their submission in support of John Key’s “financial hub” scheme, on their commercial website.

One such example is Christchurch’s Parry Field.

The opening position in their submission is nothing short of astounding. They posit:

‘One may ask, “Why introduce tax rules that would benefit wealthy foreigners?” We think this is the wrong starting point, and the question should rather be: “Why not?”’

Under the sub-heading “Why would any fund manager choose New Zealand?” Parry Field suggest eight answers, and allude to “many more“.

None of which are transparency or high compliance standards, as John Key asserted at his press conference. In fact, they cite a lack of regulations as being part of the attraction:

“Regulations imposed by the European Union and other supra-national bodies are making life increasingly difficult for the traditional financial centres.”

The cherry on the cake:

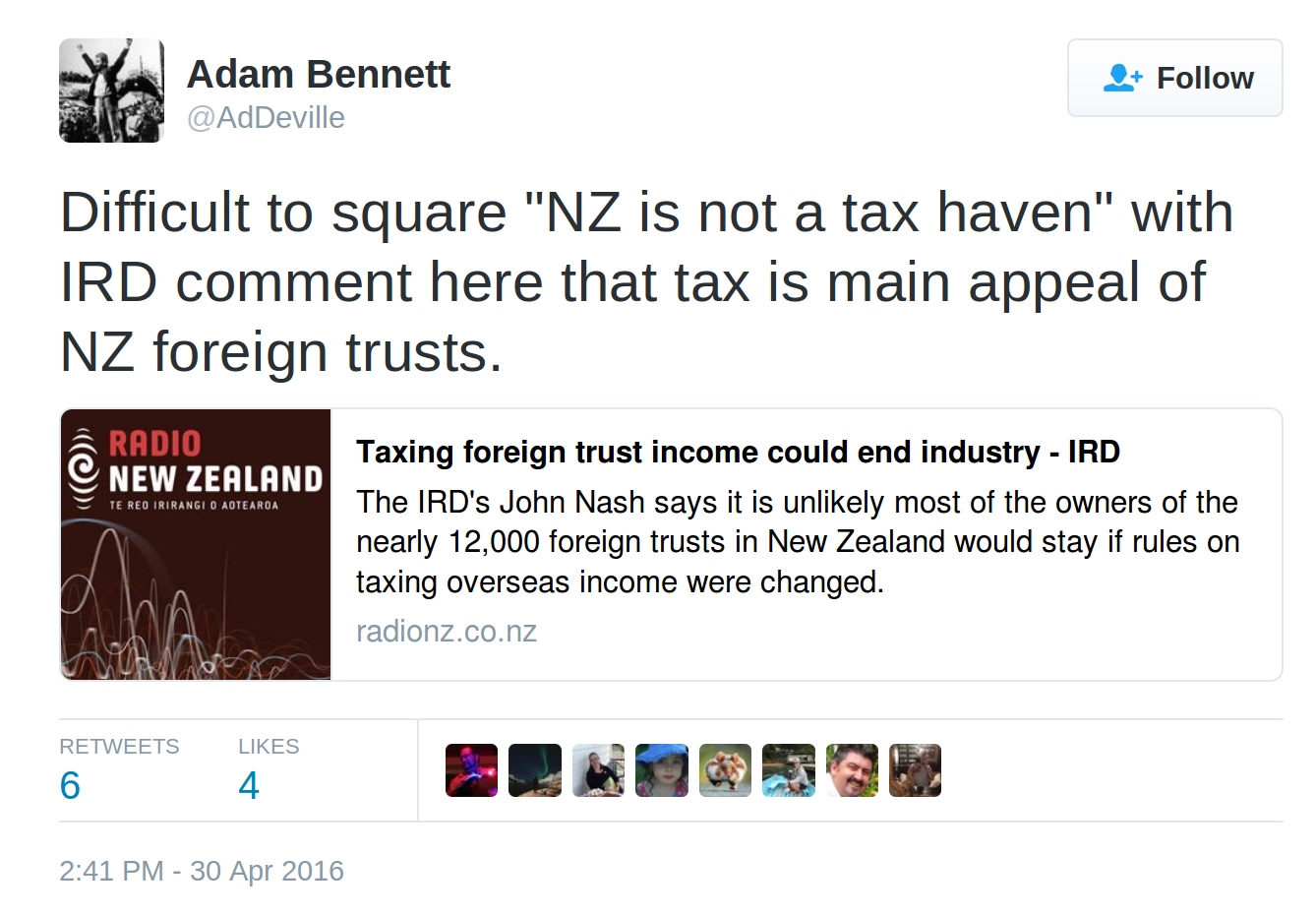

The Inland Revenue Department themselves have a different take on why tax fund managers choose New Zealand:

Back to the press conference, once it is a veteran government apologist asking a question, John Key starts sounding very much like a tax expert.

Barry Soper: “Prime Minister it is said that overseas businesses use trusts in New Zealand to avoid tax. Well we’re not undermining our tax base. But is it acceptable that they’re using…”

John Key: “…It is possible, for people to potentially, through the mismatches of the different tax systems, if they want to be creative and work hard, to significantly reduce their tax liability but in a lawful way. That is at least possible for what some multinationals are doing, and we don’t like that, and we’d like to close that down… but we can’t just magically say, New Zealand is going to stop that, we need other countries to work with us.”

So the rest of the world is to blame?

That Key fronted at all for the press conference is reassuring. The previous day he had reportedly missed his regular radio spot for the first time ever.

In New Zealand they call him ‘Teflon John’ and say nothing will stick to him – and this is why: 443 demonstrable lies and counting, and he is still in office.

Analysing The Spin

The predominant narratives coming out in John Key’s defense have all been heard before.

They are being regurgitated because they have worked in the past. He has thusfar retained his throne.

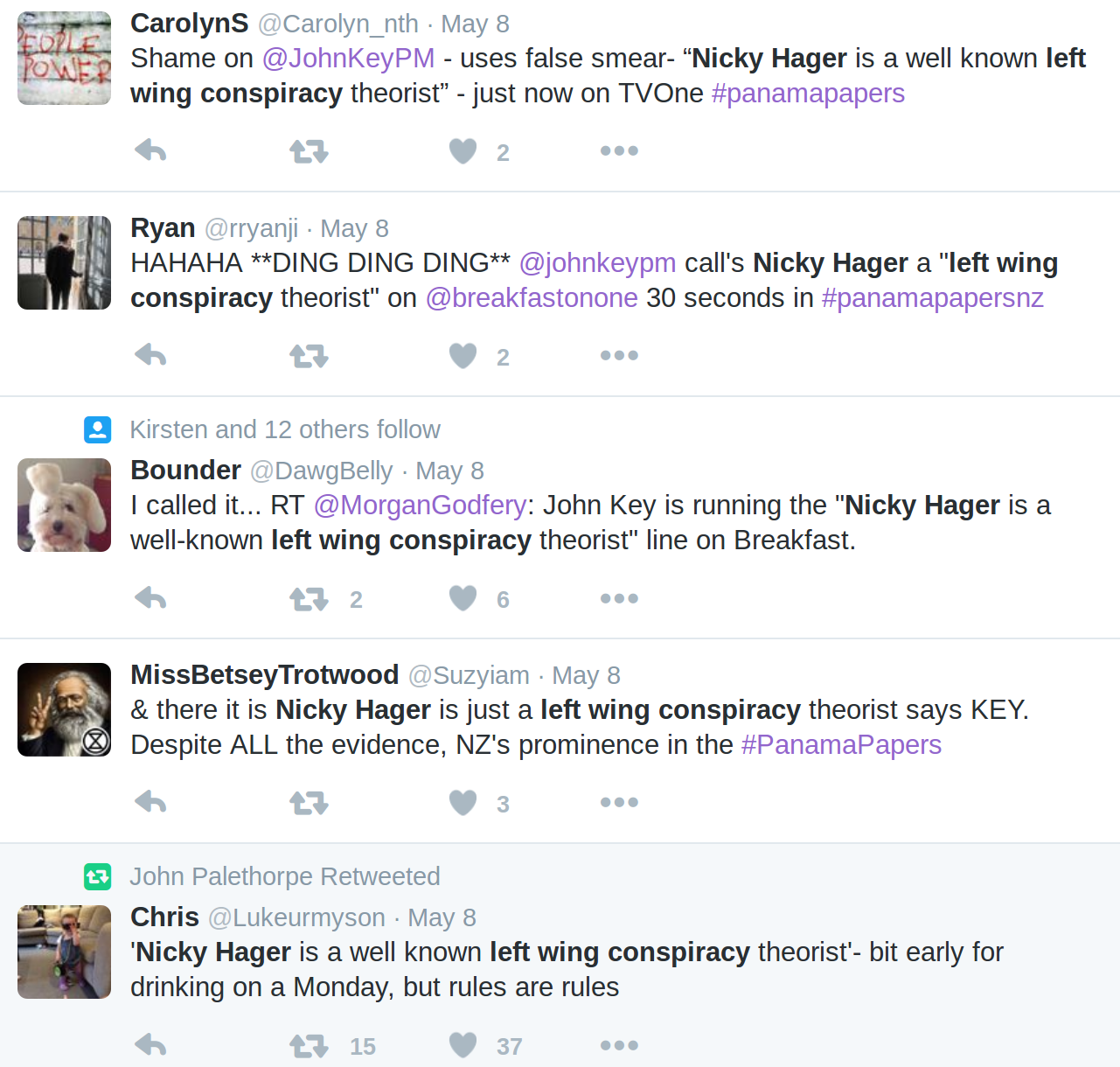

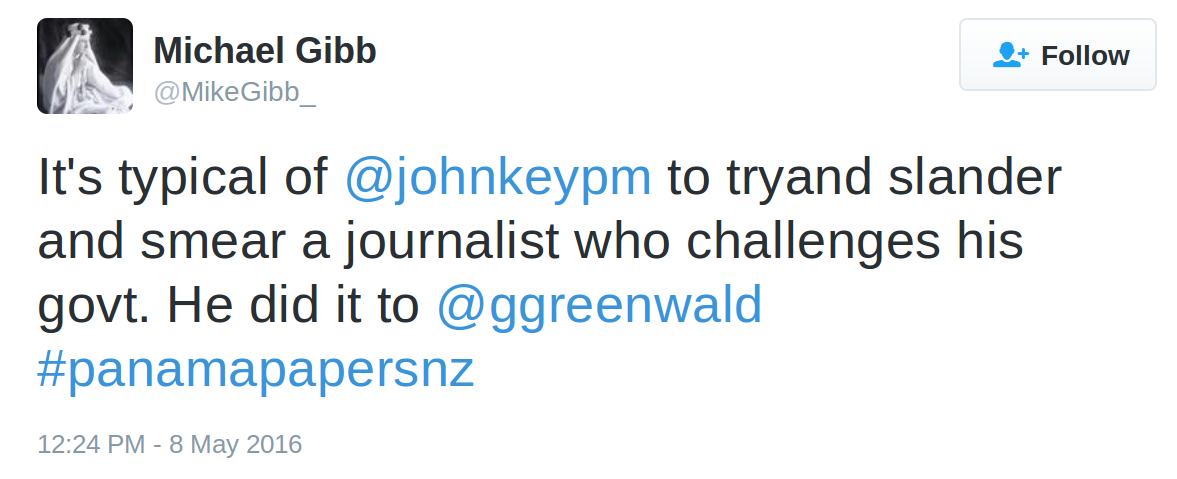

The ‘left-wing conspiracy theorist’ slur Key slung about in response to Dirty Politics and Moment of Truth, is back.

So is ‘I haven’t read it‘, and ‘I’m not an expert in that.’

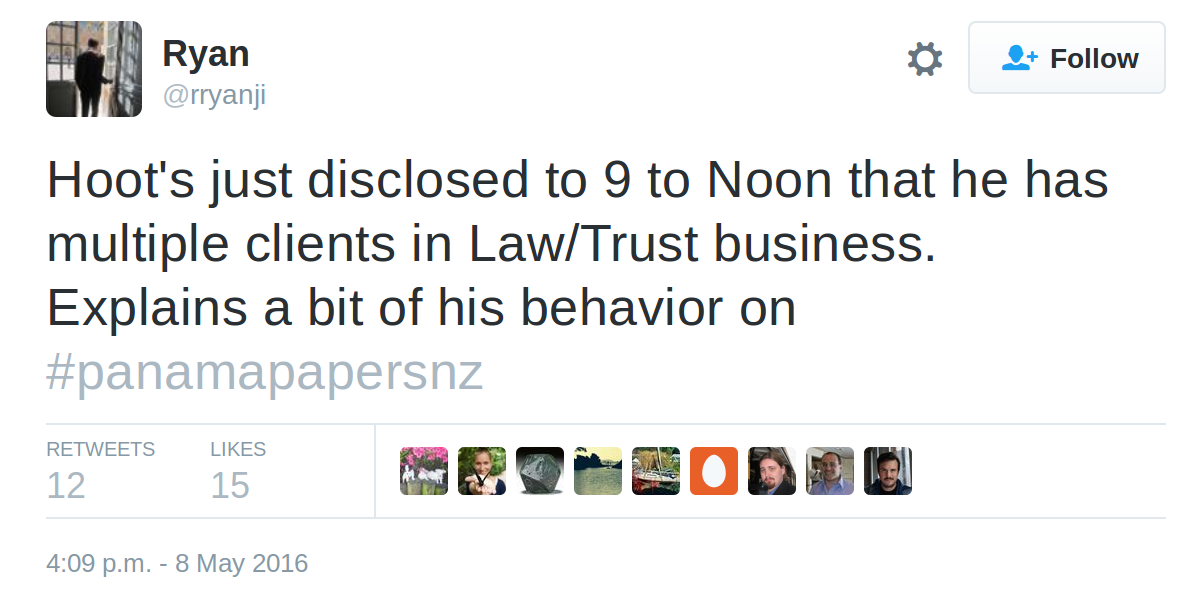

Pet commentators – and paid commentators – are hard at work, plugging away at defending the indefensible.

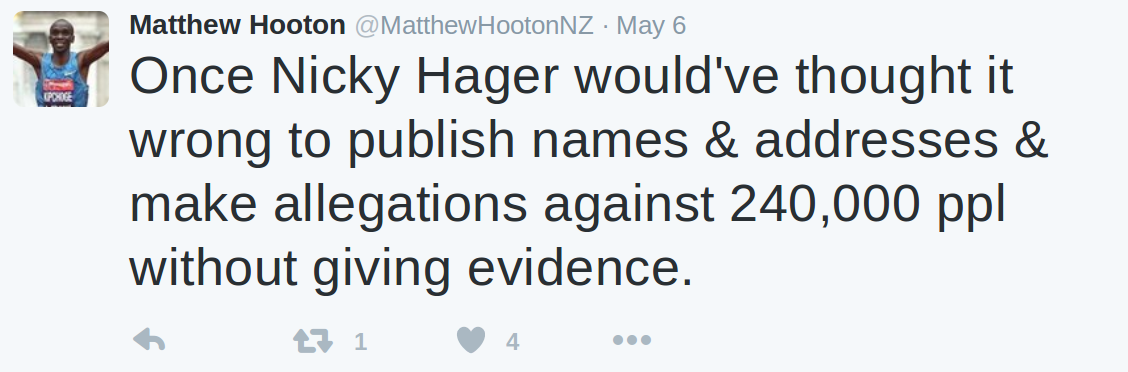

The most notable and obvious of whom are Chris Trotter (yes – this Chris Trotter) and long-time military-slash-financial-industrial-complex propagandist Matthew Hooton.

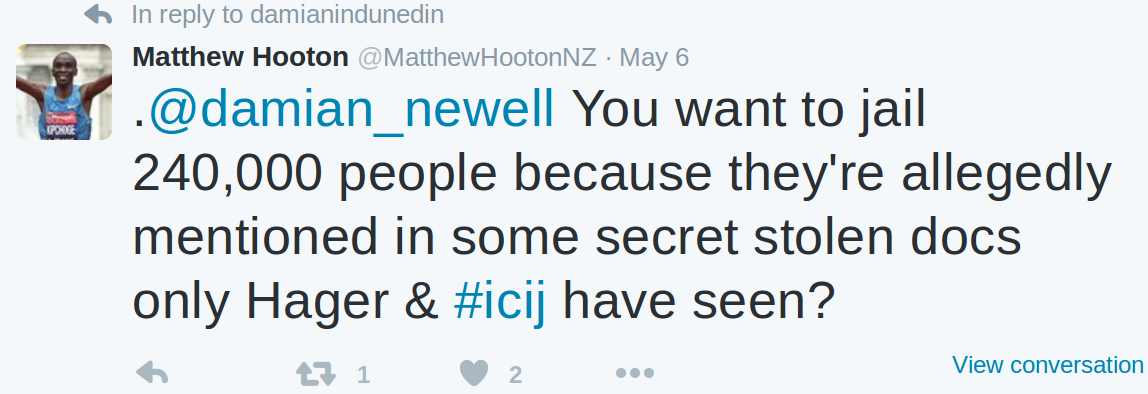

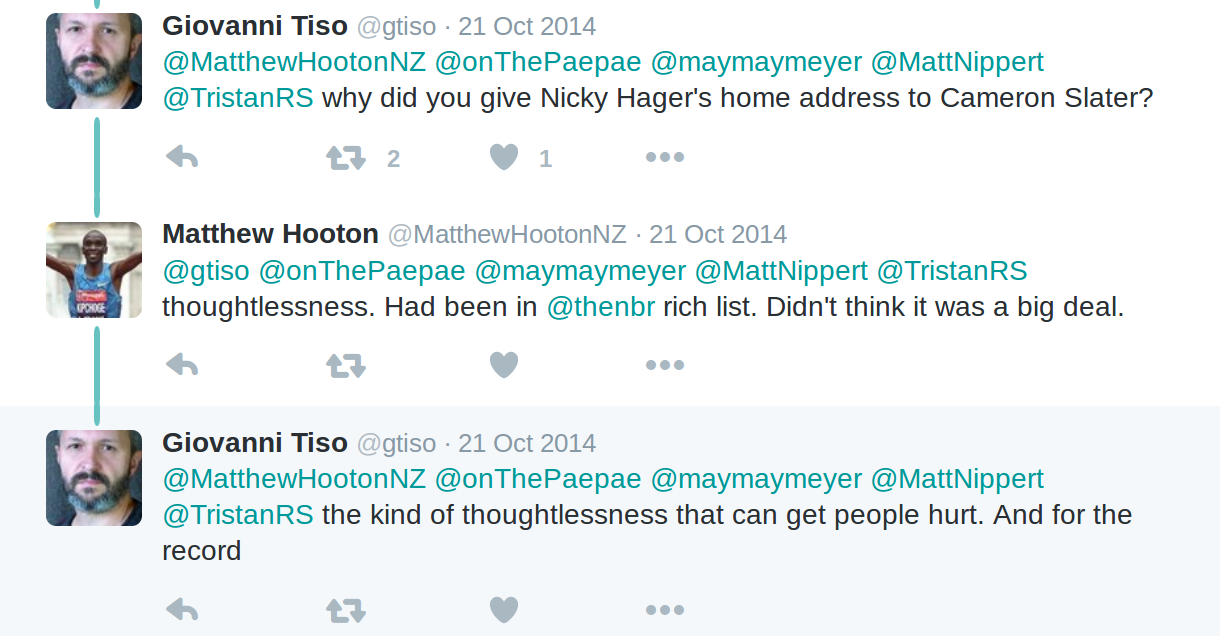

Famously implicated in Nicky Hager’s book ‘Dirty Politics’, and representing clients of a particular ilk that tend to be inconvenienced by Hager’s internationally-acclaimed investigative journalism, Hooton has many axes to grind.

He decries the documents as ‘secret’, and complains about only the journalists being able to see them.

Having apparently forgotten that he complained about only journalists being able to see them, he then complains about them being publically released too. Hooton conflates the investigation to include all trustees and plays the privacy card despite being ideologically and professionally opposed to everything that actual privacy activists stand for.

And yes – this is from the very man who was revealed to have – and admitted to – supplied Nicky Hager’s home address to political operatives with a vendetta against him.

The smearing of journalists and interference in their careers is a common theme revealed in the book Dirty Politics, and even after its release, the practice overtly continued.

So the Prime Minister has told porkies by the hundreds and the chief defenders of his socio-economic group leave much to be desired.

Doctorates vs. Spin Doctors

Whether John Key sticks it out or is finally toppled remains to be seen. At his press conference, the strain was palpable. For, despite his protestations to the contrary, Key is the public face of what is now beyond doubt an international tax haven.

According to a Working Paper by Professor Michael Littlewood published by the Auckland University Law School:

The New Zealand tax system is so structured as to allow the country to be used as a tax haven. Specifically, it allows non-residents to use trusts established in New Zealand to avoid the tax they would otherwise have to pay in their home country. This article explains how this works, and asks whether New Zealand law should be changed so as to prevent tax avoidance of this kind or, at least, to make it easier for other governments to prevent it.

As reported by Scoop.co.nz, a Massey University Accounting Professor concurs, stating:

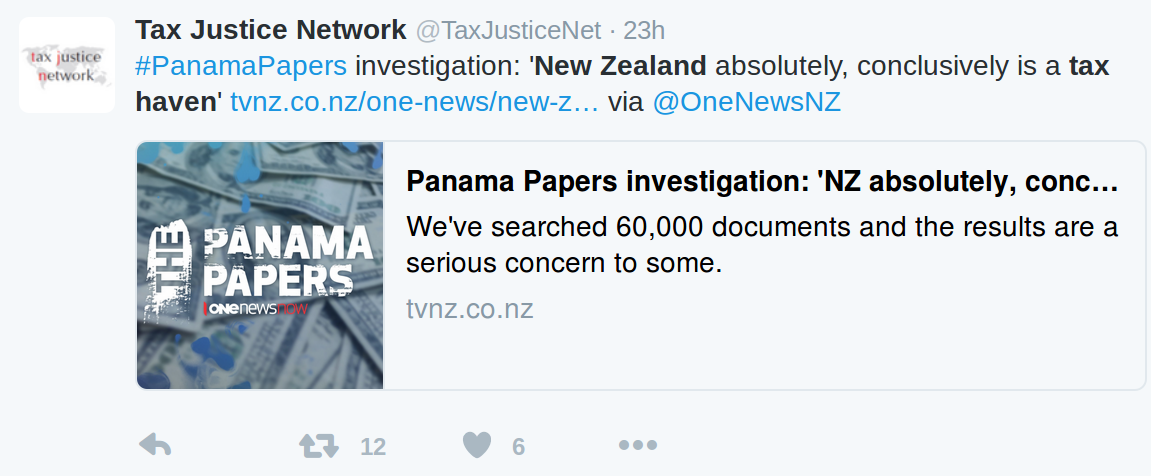

Despite the academic consensus that New Zealand is a tax haven, John Key denies it.

At 4:28 in his press conference:

Journalist: “Is New Zealand a tax haven?”

Prime Minister: “Absolutely not.”

Astonishingly, he also claims that the world doesn’t care.

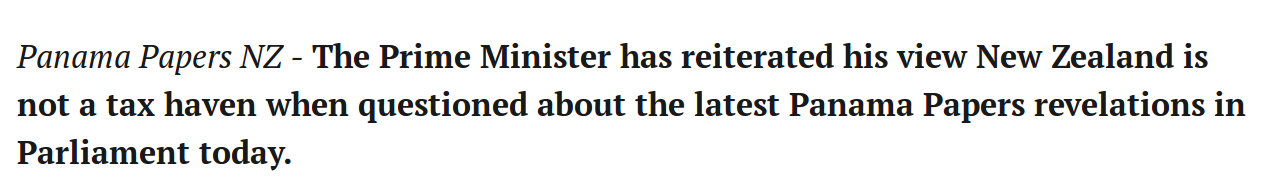

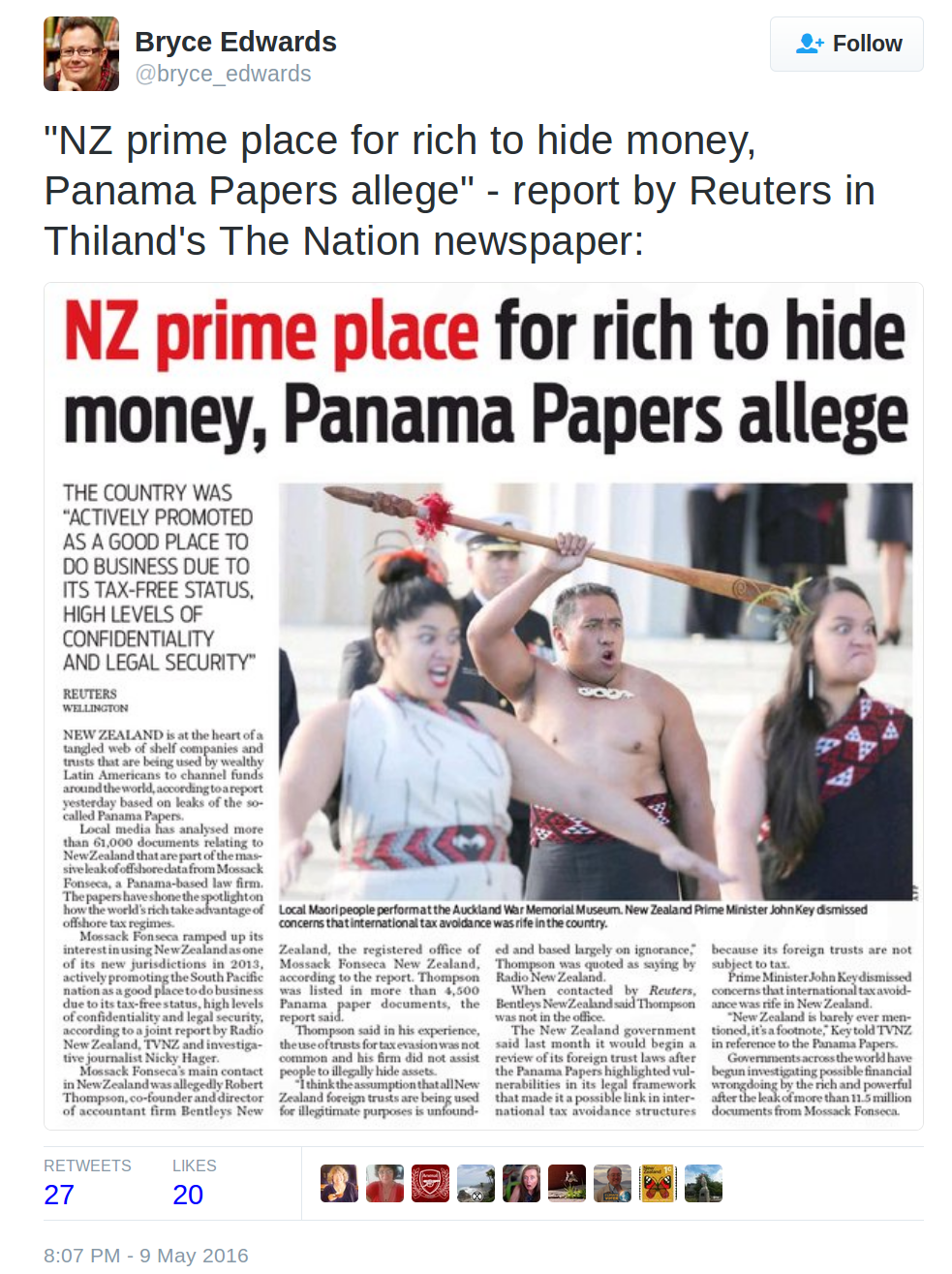

Meanwhile, #PanamaPapersNZ hit the international press.

From Nepal:

To Thailand:

From CNBC:

To ABC:

To Al Jazeera:

And……… BoingBoing!

“One New Zealand trust has already been associated with Unaoil, a Monaco company under investigation for helping multinationals bribe oil ministers and officials in the Middle East.”

If not John Key, then the Prime Minister of Malta may be the second forced resignation of a head of Government as a result of the Panama Papers.

In the wake of the scandal, thousands have attended a protest rally demanding his job. One of the trusts involved is, sure enough, registered in New Zealand.

So while the government tries to play it down, it appears that the entire world gets it. New Zealand is a tax haven – a sanctuary for dodgy money dubiously accrued by undesirable people.

The Apple Doesn’t Fall Far From The Tree

As much as he’d like to disclaim any liability, not only was the entire scheme of transforming the country into a foreign financial services hub the brainchild of New Zealand’s Grand Poobah himself – there is also a direct connection to his personal network.

The implication of John Key’s personal lawyer, Ken Whitney, is a saga unto itself.

First he was John Key’s lawyer, name-dropping the PM and lobbying a goverment Minister on behalf of the trust industry. Then he revealed that he is no longer a lawyer at all.

Now we are told that he was involved in setting up a “sham” trust that is under investigation by the Serious Fraud Office. A Trust involving backdated documents, and for which Mr Whitney admitted to witnessing a signature that required his physical presence, from half a world away.

In this High Court ruling, his conduct was described as “far from satisfactory” by a High Court judge, who also referred to Whitney’s evidence as being “inconsistent“.

Yet the Prime Minister, in the below video by Stuff.co.nz, is standing by his man. Aside from the blanket denials, perhaps the most remarkable moment is when he tells the assembled reporters “you guys were very careful last night, I think, in your coverage of these matters: the reason you were is because you don’t want to get your asses sued off you”.

The Trusts Are Only Half The Problem

New Zealand isn’t just being used as a place to stash illicit funds, but as a fake operating base for an array of banking and financial services.

As written in this July 2012 interest.co.nz article:

“Although John Key’s official financial services hub may be on the back burners, the unofficial New Zealand financial services sector is still going strong.”

The Reserve Bank issued a warning about an entity ‘also known as Irish Nationwide Bank‘…

Which is “one of about 1,000 shell companies incorporated in New Zealand over three years [that] had been used to carry out banking activities free of regulatory oversight… 143 New Zealand registered companies were implicated, over a four year period, in criminal activities overseas…”

Given all the above, it is beyond debate that:

- New Zealand is a tax haven for the benefit of the ultra-rich

- This has scandalised New Zealand’s international reputation

- New Zealand’s Prime Minister is the living embodiment of it

- His denials to the contrary are hollow and impotent

But this is all part of a much wider issue. One with implications so huge that it is rarely tackled by the news media, who instead focus on small, digestible pieces and never quite get around to confronting the elephant in the room:

New Zealand has been economically, politically, socially and militarily invaded. By our so-called allies.

Few have the guts to admit this, or to confront the reality of it.

Yet deep inside, we can feel it.

New Zealand as we knew it, no longer exists.

The Shire is being burned to the ground.

[How that happened, and the global implications will be explored in depth on our sister site ContraSpin, in Part 2 of this article, titled: “The Desecration Of New Zealand“]

Written by Suzie Dawson

Twitter: @Suzi3D

Official Website: Suzi3d.com

Journalists who write truth pay a high price to do so. If you respect and value this work, please consider supporting Suzie’s efforts via credit card or Bitcoin donation at this link. Thank you!